Maximize Profits with Straddle Strategy for Binary Options

As the name implies, the Straddle strategy involves taking a position on both sides of the market simultaneously, allowing traders to capitalize on potential price movements in either direction. By employing this technique, traders can essentially “straddle” the market, positioning themselves to profit regardless of whether the price of an asset goes up or down. This approach is particularly useful in volatile markets or during events that are expected to trigger significant price fluctuations.

One of the key advantages of the Straddle strategy is its versatility. It can be applied to a wide range of assets, including stocks, currencies, commodities, and indices, making it a valuable tool for traders across various markets. Moreover, this technique can be easily customized to suit individual risk tolerance levels and trading preferences. Whether you are an aggressive trader seeking quick gains or a conservative investor looking for steady returns, the Straddle strategy can be adapted to align with your unique goals.

Understanding the Concept of the Straddle Approach in Trading Binary Options

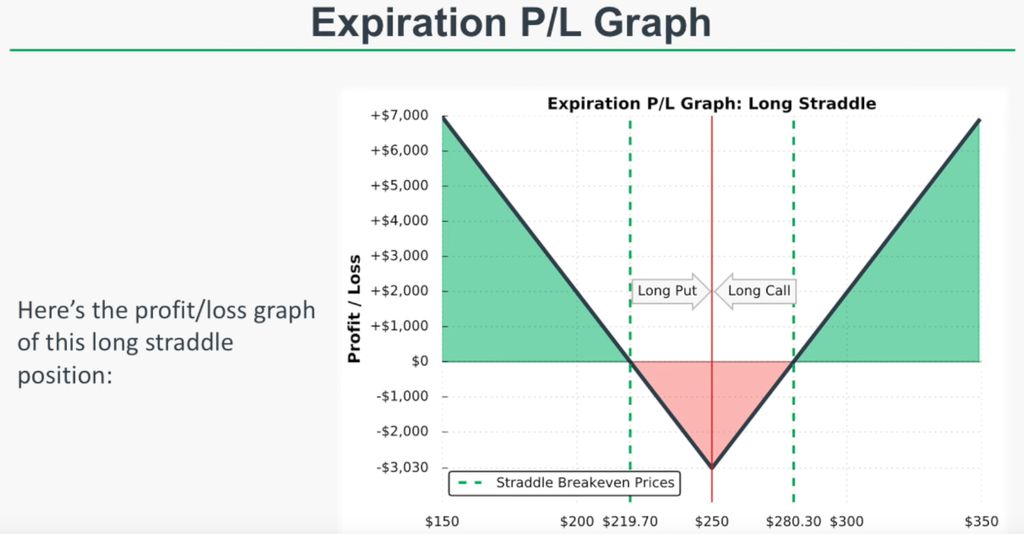

The straddle approach is a widely used technique in binary options trading that involves the simultaneous purchase of both a call option and a put option for the same underlying asset, at the same strike price, and with the same expiration date. This strategy allows traders to profit from significant price volatility, regardless of the direction in which the market moves.

- Capitalizing on Uncertainty: By employing the straddle strategy, traders can benefit from market situations where there is uncertainty or unpredictability. This approach allows them to potentially profit from significant price swings, regardless of whether the market moves up or down.

- Flexibility in Market Conditions: The straddle strategy is not dependent on the market’s direction, making it suitable for various market conditions, such as periods of high volatility, news announcements, or economic events.

- Hedging Against Losses: The purchase of both a call and a put option simultaneously provides a form of insurance, as any potential losses from one option can be offset by gains from the other option.

The strike price should be set at a level where the trader believes significant price movement is likely to occur, while the expiration date should allow sufficient time for the anticipated volatility to materialize.

Once the options are purchased, traders should closely monitor the market for any signs of price volatility. If the market moves significantly in one direction, traders can choose to exercise either the call or put option while allowing the other option to expire worthless. Alternatively, if the market remains relatively stable, traders may choose to let both options expire without exercising either.

Advantages of the Straddle Technique

The Straddle technique involves placing simultaneous call and put options on the same underlying asset, with the same strike price and expiration date. This strategy allows traders to profit from significant price movements, regardless of the direction in which the market moves.

Benefits of the Straddle Technique

- Versatility: One of the key advantages of the Straddle technique is its versatility. Traders can apply this strategy across various financial markets, including stocks, commodities, and indices.

- Protection against uncertainty: By using the Straddle technique, traders can safeguard themselves against unexpected market movements. This strategy allows them to profit in both bullish and bearish scenarios.

- Maximized profit potential: The Straddle technique enables traders to potentially maximize their profits by capitalizing on significant price fluctuations. By eliminating the need to predict the market direction, traders can benefit from large price swings.

- Reduced risk: With the Straddle technique, traders can limit their risk exposure by hedging their positions. By simultaneously holding both call and put options, any potential losses in one position can be offset by gains in the other.

- Increased trading opportunities: The Straddle technique opens up a plethora of trading opportunities, as it allows traders to take advantage of market volatility at any given time. This strategy is particularly useful during major news releases or events that may trigger significant price fluctuations.

Factors to Consider when Implementing the Straddle Technique

One of the primary considerations when implementing the straddle technique is market volatility. Traders need to identify assets or instruments that exhibit significant price fluctuations. This volatility provides the necessary conditions for the straddle strategy to be effective. By selecting volatile assets, traders can increase the likelihood of achieving profitable outcomes.

Timing of the Trade

Another crucial factor to consider is the timing of the trade. Traders must carefully analyze market trends and identify potential catalysts that could impact the price of the underlying asset. By understanding the timing of these events, traders can strategically execute the straddle strategy to maximize their chances of profiting from market movements.

Traders should also consider the duration of the trade. Depending on the specific market conditions and the anticipated impact of the catalyst, traders may opt for short-term or long-term straddle positions. This decision should be based on a thorough analysis of market dynamics and the expected duration of the price volatility.

Risk Management

Implementing proper risk management techniques is essential when utilizing the straddle strategy. Traders need to determine the appropriate amount of capital to allocate for each straddle trade, considering their overall risk appetite and trading objectives. Additionally, setting stop-loss orders and profit targets can help mitigate potential losses and secure profits.

Diversifying the straddle trades across different assets or markets can help spread the risk and minimize the impact of any adverse price movements. By carefully managing risk, traders can protect their capital and maintain a sustainable trading approach.

- Consider market volatility

- Analyze the timing of the trade

- Assess risk management strategies

- Diversify straddle trades

Analyzing market conditions, volatility, and timing

Market conditions refer to the overall state and trends observed in the financial market. By closely monitoring market conditions, traders can gain valuable insights into the current sentiment, economic indicators, and factors influencing asset prices. Understanding market conditions allows traders to identify potential opportunities and risks, enabling them to make more informed trading decisions.

Volatility plays a significant role in binary options trading as it measures the degree of price fluctuations in the market. High volatility indicates larger price swings, presenting both potential profit opportunities and increased risks. On the other hand, low volatility suggests smaller price movements, which can limit profit potential. By analyzing volatility levels, traders can adjust their strategies accordingly and choose appropriate options contracts that align with their risk tolerance and profit objectives.

Timing is another critical aspect of successful binary options trading. The ability to identify optimal entry and exit points can greatly enhance profitability. Traders need to consider various timing factors, such as economic events, news releases, and market opening hours, to make well-timed trades. By analyzing these factors, traders can increase their chances of executing trades at advantageous moments, maximizing their potential returns.

- Monitor market conditions to gain insights into current sentiment and economic indicators.

- Analyze volatility levels to adjust strategies and select suitable options contracts.

- Consider timing factors, such as economic events and market opening hours, for optimal trade execution.

Advanced Techniques to Enhance the Efficiency of the Straddle Approach

One key technique to enhance the efficiency of the straddle approach is to diversify the selection of assets. Instead of solely focusing on a single asset or market, traders can broaden their scope and consider multiple options. This diversification can help mitigate risks and provide more opportunities for profitable trades.

Timing and Volatility Analysis

Another advanced technique to consider is the incorporation of timing and volatility analysis. By closely monitoring market trends and analyzing the volatility of assets, traders can make more informed decisions on when to execute the straddle strategy. Understanding the timing and volatility can significantly increase the chances of successful trades.

Utilizing Advanced Charting Tools

Employing advanced charting tools can provide valuable insights for enhancing the effectiveness of the straddle approach. By utilizing technical analysis indicators, such as moving averages, Bollinger Bands, or Fibonacci retracements, traders can identify potential entry and exit points with greater precision.

Moreover, incorporating advanced charting techniques, such as candlestick patterns or trendline analysis, can help traders identify key support and resistance levels, further refining their straddle strategy.

- Utilize technical analysis indicators like moving averages, Bollinger Bands, or Fibonacci retracements.

- Incorporate advanced charting techniques such as candlestick patterns or trendline analysis.

- Identify potential entry and exit points with greater precision.

- Refine the straddle strategy by identifying key support and resistance levels.

Using technical indicators and fundamental analysis

Technical indicators are mathematical calculations based on historical price and volume data. They help traders identify patterns, trends, and potential reversals in the market. By utilizing a variety of technical indicators, such as moving averages, oscillators, and trend lines, traders can make more informed decisions when executing the straddle strategy.

For example, moving averages can be used to identify the overall trend of an asset’s price. By comparing different moving averages, such as the 50-day and 200-day moving averages, traders can determine whether an asset is in an uptrend or downtrend. This information can then be used to select the appropriate strike prices for the straddle options.

Oscillators, on the other hand, can help traders identify overbought or oversold conditions in the market. By using indicators such as the Relative Strength Index (RSI) or the Stochastic Oscillator, traders can anticipate potential reversals in price and adjust their straddle positions accordingly.

FAQ:

What is the straddle strategy in binary options trading?

The straddle strategy is a popular trading strategy in binary options where a trader places two opposite positions at the same time, one call option and one put option, with the same strike price and expiration time. This strategy is used when the trader expects high market volatility but is unsure about the direction of the price movement.

How does the straddle strategy work?

The straddle strategy works by taking advantage of market volatility. When a trader places a straddle, they are essentially betting that the price will move significantly in either direction. If the price goes up, the call option will be profitable, and if the price goes down, the put option will be profitable. The goal is to make a profit regardless of the direction of the price movement.

What are the advantages of using the straddle strategy in binary options trading?

The advantages of using the straddle strategy include the ability to profit from high market volatility, the potential for significant returns, and the flexibility to trade in any market condition. This strategy also allows traders to limit their potential losses by setting stop-loss orders.

Are there any risks associated with the straddle strategy?

Yes, there are risks associated with the straddle strategy. One of the main risks is that the price may not move significantly in either direction, resulting in both options expiring out of the money and the trader losing the invested amount. Additionally, if the market is not volatile enough, the premiums paid for the options may be too high, reducing potential profits.

Can the straddle strategy be used by beginners in binary options trading?

Yes, the straddle strategy can be used by beginners in binary options trading. However, it is important for beginners to have a good understanding of market volatility and the factors that can affect price movements. It is also recommended to practice with a demo account before using real money and to start with smaller investments until gaining more experience and confidence in using this strategy.

What is a straddle strategy in binary options trading?

A straddle strategy in binary options trading involves simultaneously placing both a call option and a put option on the same underlying asset, with the same expiration date and strike price. This strategy is used when the trader expects significant price volatility but is unsure about the direction of the price movement.