Profits with a Range Trading Strategy for Binary Options

Range trading, also known as channel trading, refers to a strategy that focuses on identifying and capitalizing on the price movements within a defined range. This technique is particularly useful in markets that display periods of consolidation, where prices tend to oscillate between support and resistance levels. By recognizing these predictable patterns, traders can strategically enter and exit positions to generate consistent profits.

Enhancing Precision with Technical Analysis

One of the key components of a successful range trading strategy is the utilization of technical analysis tools. These tools, such as trend lines, moving averages, and oscillators, provide traders with valuable insights into market dynamics. By identifying key support and resistance levels, trend reversals, and overbought or oversold conditions, traders can make informed decisions and increase the probability of profitable trades.

The Importance of Risk Management

While range trading can be a highly profitable strategy, it is crucial to implement effective risk management techniques to mitigate potential losses. Traders must set clear stop-loss orders and adhere to them, ensuring that any losses are limited and controlled. Additionally, proper position sizing and diversification play a vital role in managing risk and protecting capital.

Mastering the art of range trading is a skill that can significantly enhance a trader’s success in the financial markets. By understanding the principles of range-bound movements, utilizing technical analysis tools, and implementing effective risk management strategies, traders can unlock the potential for consistent profits.

Remember, success in trading is not merely about luck or guesswork – it is a disciplined approach that requires knowledge, practice, and a deep understanding of market dynamics.

Understanding the Concept of Range Trading in Binary Options

When it comes to trading binary options, one strategy that traders often employ is range trading. This approach focuses on identifying and capitalizing on price movements within a specific range or boundary. By understanding the concept of range trading, traders can effectively predict and profit from market fluctuations without relying on the direction of the overall trend.

The Basics of Range Trading

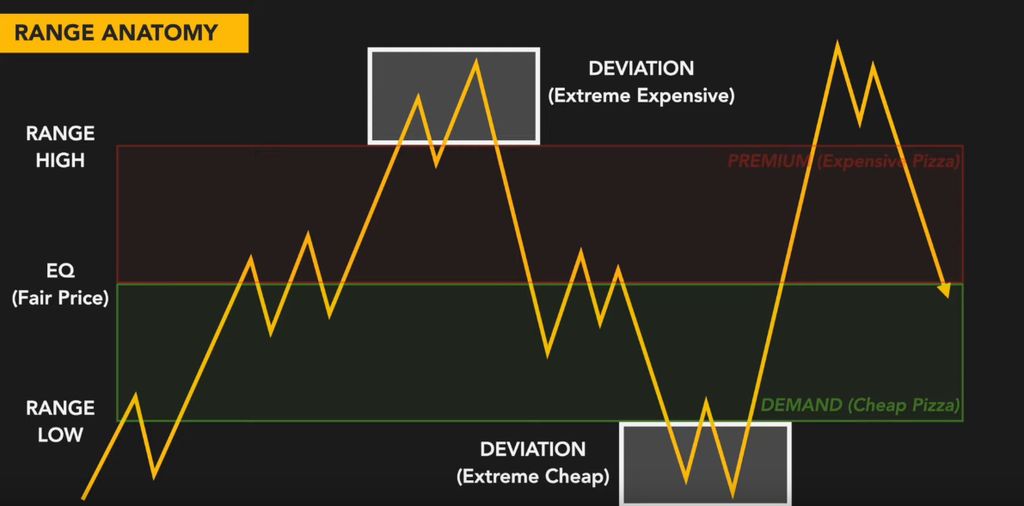

Range trading involves identifying key levels of support and resistance in the market. These levels act as boundaries within which the price of an asset tends to fluctuate. Traders analyze historical price data to identify these levels and then use them to predict future price movements. The goal is to buy at the bottom of the range and sell at the top, or vice versa, depending on the direction of the price movement.

Utilizing Technical Indicators

In order to effectively implement a range trading strategy, traders often rely on various technical indicators. These indicators help identify when an asset is approaching a support or resistance level, providing valuable insights for making trading decisions. Commonly used indicators include moving averages, Bollinger Bands, and the Relative Strength Index (RSI). By combining these indicators with price action analysis, traders can increase their chances of success in range trading.

| Advantages of Range Trading | Disadvantages of Range Trading |

|---|---|

| 1. Allows traders to profit in both bullish and bearish market conditions. | 1. Limited profit potential compared to trend-following strategies. |

| 2. Provides clear entry and exit points based on support and resistance levels. | 2. Requires patience and discipline to wait for price to reach the desired range. |

| 3. Can be applied to various time frames, making it suitable for different trading styles. | 3. False breakouts can lead to losses if not properly identified. |

Exploring the Fundamentals of Range Trading Approach

Range trading is a widely recognized technique employed in financial markets to identify and capitalize on price fluctuations within a defined range. This approach focuses on identifying key support and resistance levels, creating a trading range where price tends to oscillate. By understanding the basics of range trading, traders can potentially profit from market conditions characterized by limited price movements.

Understanding Support and Resistance Levels

Support and resistance levels are fundamental concepts in range trading. Support refers to a price level where buying pressure is expected to prevent further price declines, while resistance represents a level where selling pressure is anticipated to prevent further price increases. These levels are determined by analyzing historical price patterns, such as previous highs and lows, and are considered as potential turning points for future price movements.

Identifying Trading Ranges

Once support and resistance levels are established, traders can identify the trading range within which price tends to fluctuate. This range is created by connecting the highest and lowest points where price has historically reversed or consolidated. By visually plotting these levels on a price chart, traders can gain insights into the boundaries within which price is likely to remain for a certain period of time.

- Price tends to bounce off the support level towards the resistance level within the defined range.

- Conversely, price often retreats from the resistance level towards the support level.

- Trading opportunities arise when price approaches either the support or resistance level, as traders can anticipate potential reversals or breakouts.

By effectively utilizing range trading strategies, traders can potentially profit from price movements within a defined range, taking advantage of both upward and downward price swings.

Identifying Key Indicators for Efficient Range-Based Trading

1. Price Volatility

One of the crucial indicators for range-based trading is price volatility. Volatility refers to the magnitude of price fluctuations within a given timeframe. By monitoring and analyzing price volatility, traders can determine the potential range within which an asset is likely to trade. This information enables traders to establish appropriate entry and exit points, consequently maximizing profit potential.

2. Support and Resistance Levels

Support and resistance levels are key technical indicators that offer valuable insights into potential price reversals within a range. Support levels represent price levels at which buying pressure is expected to outweigh selling pressure, causing prices to bounce back. Conversely, resistance levels indicate price levels at which selling pressure is expected to outweigh buying pressure, leading to potential price decreases. By accurately identifying these levels, traders can make informed decisions on when to enter or exit trades, optimizing their range-based trading strategy.

| Key Indicators | Description |

|---|---|

| Price Volatility | Refers to the magnitude of price fluctuations within a given timeframe |

| Support and Resistance Levels | Represent price levels indicating potential price reversals within a range |

Mastering Technical Analysis for Range Trading in Binary Options

Technical analysis is a method of evaluating market data, such as price and volume, to identify patterns and trends that can help predict future price movements. It involves the use of various tools, such as indicators and chart patterns, to analyze historical data and make forecasts about future market behavior.

Key Indicators and Chart Patterns

There are numerous technical indicators and chart patterns that range traders can utilize to enhance their trading strategies. These tools provide valuable information about market sentiment, support and resistance levels, and potential price reversals.

Some commonly used indicators include moving averages, relative strength index (RSI), and Bollinger Bands. Moving averages help identify trends and smooth out price fluctuations, while RSI measures the strength and speed of price movements. Bollinger Bands, on the other hand, indicate volatility and potential price breakouts.

Using Support and Resistance Levels for Range Trading

Support and resistance levels are key concepts in technical analysis that help traders identify potential turning points in the price of an asset. Support levels indicate a price level where buying pressure is expected to be strong enough to prevent the price from falling further. On the other hand, resistance levels indicate a price level where selling pressure is expected to be strong enough to prevent the price from rising further.

Using Support and Resistance Levels for Range Trading

- Identifying Range Boundaries: Support and resistance levels can be used to identify the upper and lower boundaries of a trading range. By plotting these levels on a price chart, traders can visually determine the range within which an asset is likely to trade.

- Entering Trades: Once the range boundaries are identified, traders can enter trades when the price approaches either the support or resistance level. If the price reaches the support level, traders may consider buying the asset, expecting a bounce back within the range. Conversely, if the price reaches the resistance level, traders may consider selling the asset, anticipating a reversal back within the range.

- Managing Risk: Support and resistance levels can also be used to manage risk in range trading. Traders can set stop-loss orders just below the support level when buying or just above the resistance level when selling. This helps limit potential losses if the price breaks out of the range.

- Confirming Breakouts: Support and resistance levels can also be used to confirm breakouts from a range. If the price convincingly breaks above the resistance level, it may indicate a bullish breakout, suggesting a potential uptrend. Conversely, if the price convincingly breaks below the support level, it may indicate a bearish breakout, suggesting a potential downtrend.

The Significance of Moving Averages in the Context of Range-Based Trading Approaches

One of the primary functions of moving averages in range trading strategies is to help traders identify the boundaries of a trading range. By calculating the average price over a specific period, these indicators offer a clear representation of the market sentiment and the prevailing price levels that are likely to act as barriers for the price movement. Traders can then use this information to establish appropriate entry and exit points, maximizing the profitability of their trades.

Moreover, moving averages also play a significant role in determining the strength and sustainability of a trading range. By comparing different moving averages with varying timeframes, traders can gain insights into the degree of momentum and volatility within the market. This analysis enables traders to make informed decisions about the suitability of a particular range for trading, ensuring that they are not entering into a range that lacks sufficient price movement to generate profitable opportunities.

Furthermore, moving averages can act as dynamic support and resistance levels within a trading range. As the price approaches these averages, traders can observe whether the price bounces off or breaks through them. This behavior provides valuable signals about potential price reversals or continuations, allowing traders to adjust their trading strategies accordingly. By combining moving averages with other technical indicators, traders can enhance the accuracy of their predictions and increase their chances of success in range trading.

FAQ:

What is a range trading strategy for binary options?

A range trading strategy for binary options is a trading approach that focuses on identifying and trading within a specific price range. Traders using this strategy aim to profit from the price oscillations that occur within a defined range.

How does a range trading strategy work?

A range trading strategy works by identifying key levels of support and resistance within a price range. Traders look for opportunities to buy near support and sell near resistance, expecting the price to bounce back and forth within the range. This strategy requires patience and careful analysis of price action.

What are the advantages of using a range trading strategy for binary options?

One advantage of using a range trading strategy for binary options is that it allows traders to take advantage of predictable price movements within a specific range. This strategy can be particularly useful in sideways markets where the price is not trending strongly in one direction. Range trading also allows for better risk management as traders can set clear stop-loss levels.

Are there any drawbacks to using a range trading strategy for binary options?

One drawback of using a range trading strategy for binary options is that it requires a good understanding of support and resistance levels and the ability to accurately identify range-bound market conditions. Traders also need to exercise patience and discipline, as trading within a range can be less exciting compared to trading during strong trends. Additionally, false breakouts can occur, leading to potential losses.