Pinocchio Strategy: Boosting Your Binary Options Trading

The Nosey Nick Approach involves closely monitoring the price of an asset and looking for signs of deception, just like Pinocchio’s nose growing longer when he told a lie. Traders using this method keep an eye out for specific candlestick patterns, such as long wicks or shadows, which indicate that the market sentiment may be misleading. By recognizing these patterns and understanding their significance, traders can anticipate potential reversals and adjust their trading strategies accordingly.

Implementing the Nosey Nick Approach requires a combination of technical analysis skills and a keen eye for detail. Traders must be able to interpret candlestick charts and identify key levels of support and resistance. Additionally, they must have the discipline to patiently wait for confirmation of their predictions before entering a trade. While this approach may not guarantee success in every trade, it provides traders with a valuable tool to enhance their decision-making process and increase their chances of profitable outcomes.

Identifying Telltale Patterns for Profitable Trading

When it comes to achieving success in binary options trading, it is crucial to have a keen eye for identifying specific patterns that can indicate potential market movements. By recognizing these telltale signs, traders can make informed decisions and increase their chances of making profitable trades.

- False Breakouts: One common pattern to watch out for is false breakouts. These occur when the price of an asset appears to break through a significant support or resistance level but quickly retraces back in the opposite direction. False breakouts can be indicative of market manipulation or temporary shifts in investor sentiment, providing an opportunity for traders to capitalize on the reversal.

- Engulfing Candles: Another pattern to keep an eye on is engulfing candles. These candles occur when the body of one candle completely engulfs the body of the previous candle. An upward engulfing candle can signal a potential bullish reversal, while a downward engulfing candle can indicate a bearish reversal. Traders can use this pattern as a signal to enter or exit a trade, depending on the overall market trend.

- Doji Candles: Doji candles are characterized by their small bodies and long wicks, indicating indecision in the market. These candles often occur at key support or resistance levels and can signal a potential trend reversal. Traders should pay attention to the direction of the next candle following a doji, as it can provide valuable insights into the future market direction.

- Volume Spikes: Unusual spikes in trading volume can also indicate a potential market reversal. When the volume suddenly increases significantly, it suggests a surge in buying or selling pressure. Traders should closely monitor volume spikes in conjunction with other technical indicators to confirm potential trend reversals and make informed trading decisions.

- Convergence of Indicators: A convergence of multiple technical indicators can provide strong confirmation for potential trading opportunities. For example, when several indicators, such as moving averages, trend lines, and oscillators, align in the same direction, it suggests a higher probability of a successful trade. Traders should consider these convergences as potential entry or exit points.

Implementing the Pinocchio Approach: Insights and Best Practices

1. Understanding the Psychology of Price Movements

Before diving into the specifics of implementing the Pinocchio approach, it is crucial to develop a solid understanding of the psychology behind price movements. By recognizing the patterns and behaviors of market participants, you can better identify potential false breakouts and anticipate price reversals. This knowledge will serve as a foundation for effectively applying the Pinocchio strategy.

2. Identifying Pinocchio Candlestick Patterns

The Pinocchio strategy revolves around identifying specific candlestick patterns that indicate potential reversals in market trends. These patterns, often characterized by long wicks and small bodies, resemble Pinocchio’s elongated nose. By carefully analyzing price charts and recognizing these patterns, you can pinpoint potential entry and exit points for your trades.

Factors such as support and resistance levels, trendlines, and other technical indicators can provide additional confirmation and enhance the accuracy of your trading decisions.

| Tips for Implementing the Pinocchio Strategy |

|---|

| 1. Patience is key: Wait for clear and strong Pinocchio candlestick patterns before entering a trade. |

| 2. Combine with other indicators: Use additional technical indicators to confirm the validity of Pinocchio signals. |

| 3. Practice risk management: Set appropriate stop-loss orders and manage your risk effectively to protect your capital. |

| 4. Backtest and analyze: Test the Pinocchio strategy on historical data and analyze its performance to refine your approach. |

| 5. Keep emotions in check: Stick to your trading plan and avoid making impulsive decisions based on fear or greed. |

FAQ:

What is the Pinocchio strategy for binary options?

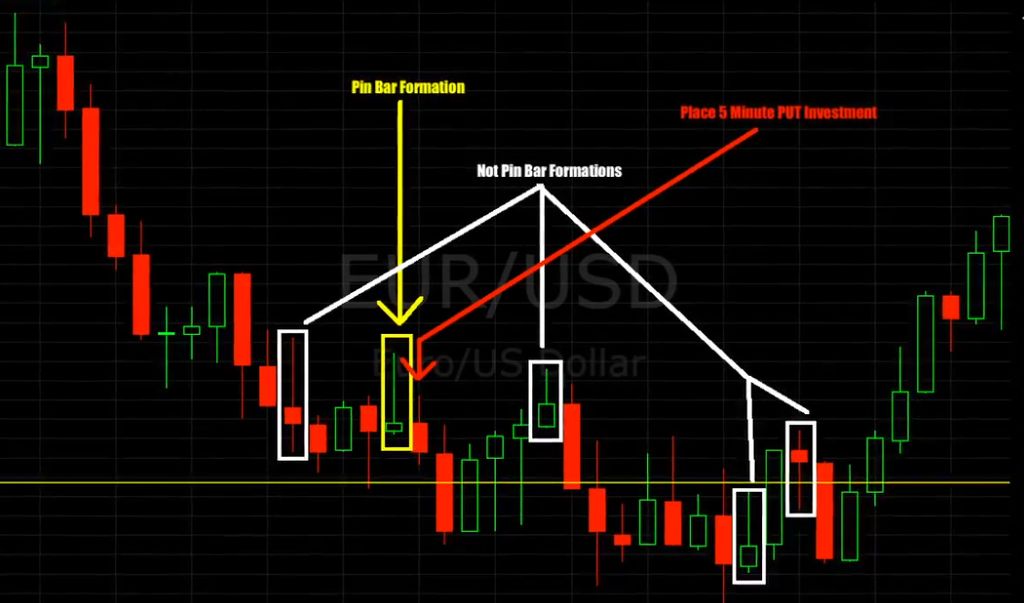

The Pinocchio strategy for binary options is a trading technique that involves identifying false breakouts in the market. It is based on the concept that when the market shows a strong movement in one direction, it is often a deception or a “lie” by the market. Traders using this strategy look for pin bars, which are candlestick patterns that have a long wick or shadow, indicating a rejection of higher or lower prices. This pattern suggests that the market is likely to reverse its direction, providing an opportunity for profitable trades.

How does the Pinocchio strategy work?

The Pinocchio strategy works by recognizing pin bar formations on the price chart. When a pin bar appears, it suggests that the market is lying or deceiving traders by showing a false breakout. Traders using this strategy wait for the pin bar to close and then enter a trade in the opposite direction of the breakout. For example, if the pin bar has a long upper wick, indicating a rejection of higher prices, traders would enter a short trade, expecting the market to reverse and move downwards. The strategy relies on the principle of market psychology and the belief that false breakouts are common.

What are the advantages of using the Pinocchio strategy?

The Pinocchio strategy offers several advantages for binary options traders. Firstly, it helps traders avoid false breakouts and reduces the risk of entering trades based on deceptive market movements. Secondly, it provides clear entry and exit signals, making it easier for traders to execute their trades. Additionally, the strategy can be used in various timeframes and with different underlying assets, making it versatile. Lastly, the Pinocchio strategy can be combined with other technical analysis tools and indicators to enhance its effectiveness.

Are there any limitations or risks associated with the Pinocchio strategy?

Like any trading strategy, the Pinocchio strategy has its limitations and risks. One of the main limitations is that it requires a certain level of skill and experience to correctly identify pin bar formations and interpret their implications. False signals can occur, leading to potential losses. Additionally, the strategy may not work well in certain market conditions, such as highly volatile or trending markets. Traders should also be aware of the risk of overtrading or relying solely on this strategy without considering other factors. Risk management techniques should always be applied to mitigate potential losses.