Hedging Strategy for Binary Options: Minimizing Risk Strategic

By employing a well-thought-out and carefully executed approach, investors can adopt a method that safeguards their investments against potential downturns, while also providing ample opportunities for profit. This approach, known as a hedging strategy, is a time-tested technique that has gained significant popularity in recent years.

The concept of hedging, investors can proactively protect their investments from adverse market movements, thus ensuring that their hard-earned capital remains secure. Through this strategic approach, individuals can minimize potential losses and enhance the overall profitability of their investment portfolio.

Hedging in the financial markets involves employing a range of techniques that aim to offset the risks associated with volatile price movements. By diversifying their investment holdings and strategically placing trades, investors can create a balanced portfolio that can withstand market fluctuations. This allows them to capitalize on profitable opportunities, while simultaneously safeguarding their investments from any unforeseen downturns.

Exploring the Concept of Safeguarding in Digital Options

Safeguarding in digital options involves the implementation of specific measures aimed at reducing potential risks and maximizing the likelihood of favorable outcomes. It is a proactive approach that allows traders to protect their investments and minimize the impact of adverse market fluctuations. By employing a range of techniques and tools, traders can create a safety net that shields them from significant losses while still allowing for the possibility of substantial profits.

Exploring the techniques of safeguarding

There are various techniques that traders can employ to effectively safeguard their investments in digital options. One such technique is diversification, which involves spreading investment across multiple assets or markets. This strategy helps to reduce the impact of market volatility on a single investment, as losses in one area can be offset by gains in another. Another technique is the use of stop-loss orders, which automatically trigger the sale of an asset when it reaches a predetermined price, limiting potential losses.

The importance of risk management

Central to the concept of safeguarding in digital options is the practice of rigorous risk management. Traders must carefully assess their risk tolerance and set clear limits on the amount of capital they are willing to put at stake. By establishing and adhering to these limits, traders can effectively control their exposure to potential losses and ensure the longevity of their trading endeavors.

The role of research and analysis

Another crucial aspect of safeguarding in digital options is the diligent research and analysis of market trends and indicators. By staying informed and up-to-date with the latest market developments, traders can make informed decisions and adjust their strategies accordingly. This knowledge empowers traders to identify potential risks and opportunities, allowing them to make calculated moves that maximize profits and minimize risks.

Maximizing Gains through Effective Implementation of a Profit-Boosting Approach

Before diving into the details of implementing a profit-maximizing strategy, it is imperative to develop a profound comprehension of market dynamics. By closely monitoring and analyzing market trends, traders can identify potential opportunities and forecast future price movements. This knowledge serves as a solid foundation for constructing a robust hedging framework that can effectively mitigate risks and capitalize on market fluctuations.

Creating a Diversified Portfolio

A key aspect of maximizing profits lies in constructing a diversified portfolio. By spreading investments across various assets and sectors, traders can minimize the impact of potential losses and optimize their overall returns. This diversification strategy allows for the allocation of resources in a manner that balances potential risks and rewards, ultimately enhancing the profitability of the trading approach.

Within this diversified portfolio, it is essential to identify assets that exhibit low correlation. By selecting assets that move independently of each other, traders can further reduce the overall risk exposure. This approach enables them to capitalize on favorable price movements while minimizing the impact of adverse market conditions.

Emphasizing Risk Management

Implementing a hedging strategy to maximize profits necessitates a strong focus on risk management. By employing risk mitigation techniques such as stop-loss orders, traders can limit potential losses and protect their investment capital. Additionally, regularly reassessing and adjusting risk levels based on market conditions can help traders adapt to evolving market dynamics, further safeguarding their profits.

Potential Challenges in Hedging Binary Options

When engaging in hedging activities within the realm of binary options, it is essential to take into account several crucial considerations and be aware of the associated risks. By understanding these key factors, traders can enhance their decision-making processes and navigate potential challenges more effectively.

Correlation refers to the statistical relationship between two or more assets and determines how they move in relation to each other. Understanding the correlation between assets is vital for effective hedging as it helps traders identify opportunities to offset potential losses. However, it is important to note that correlations can change over time, requiring constant monitoring and adjustment of hedging positions.

Liquidity is a critical factor when it comes to hedging binary options. Liquidity refers to the ease with which an asset can be bought or sold without significantly affecting its price. Assets with high liquidity provide traders with greater flexibility and efficiency in executing hedging strategies. On the other hand, low liquidity assets can pose challenges, potentially leading to slippage and increased transaction costs.

Hedging strategies often involve the use of derivative instruments, such as options or futures contracts, which come with associated costs. These costs can erode potential profits and need to be carefully evaluated to ensure the overall effectiveness of the hedging strategy.

FAQ:

What is a hedging strategy for binary options?

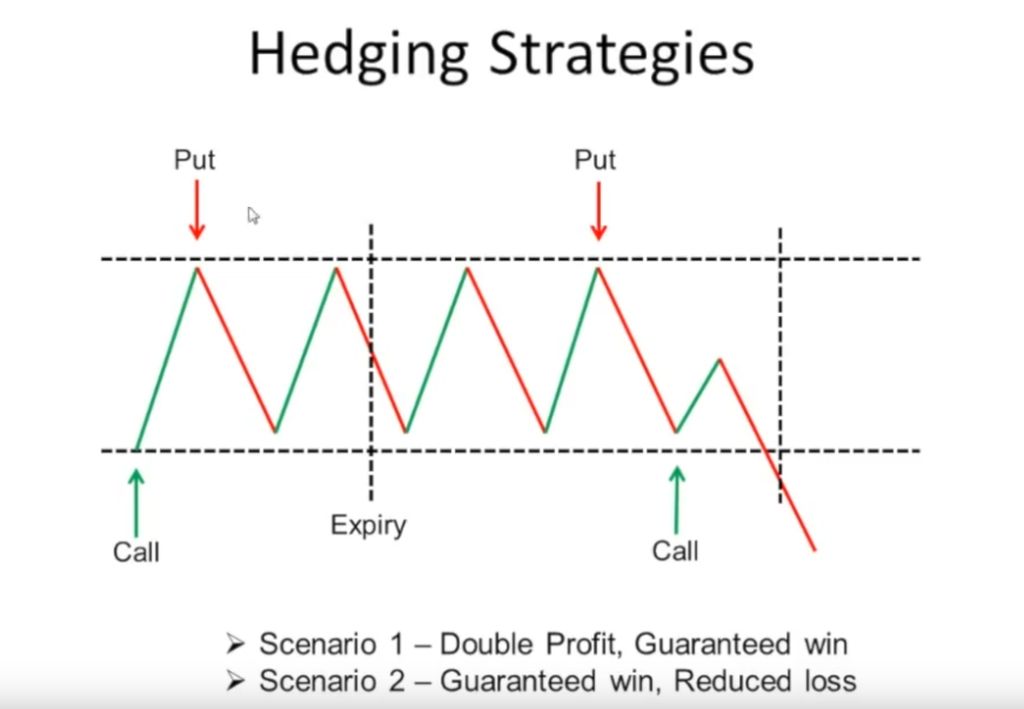

A hedging strategy for binary options is a technique used by traders to reduce the risk associated with their trades. It involves placing multiple trades in opposite directions to offset potential losses.

How does a hedging strategy work?

A hedging strategy works by opening two or more trades in opposite directions. If one trade results in a loss, the other trade should result in a profit, thus minimizing overall losses. It is a way to protect investments from market volatility.

What are the benefits of using a hedging strategy?

Using a hedging strategy can help traders minimize potential losses and protect their investments. It allows for more flexibility in trading and reduces the impact of market fluctuations. Additionally, it can provide opportunities for profit in both rising and falling markets.

Are there any risks associated with using a hedging strategy?

While a hedging strategy can reduce risks, it is not without its own risks. If both trades in a hedging strategy result in losses, the trader may still experience significant losses. Additionally, the cost of executing multiple trades can eat into potential profits. It requires careful planning and analysis to be effective.

What are some common hedging techniques used in binary options trading?

Some common hedging techniques in binary options trading include using options contracts, using different expiry times for trades, and diversifying the types of assets traded. Traders may also use technical analysis indicators to identify potential hedging opportunities.